BESS tax rate for energy storage power stations

Welcome to our dedicated page for BESS tax rate for energy storage power stations! Here, we have carefully selected a range of videos and relevant information about BESS tax rate for energy storage power stations, tailored to meet your interests and needs. Our services include high-quality home solar systems, photovoltaic panels, and advanced inverters, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

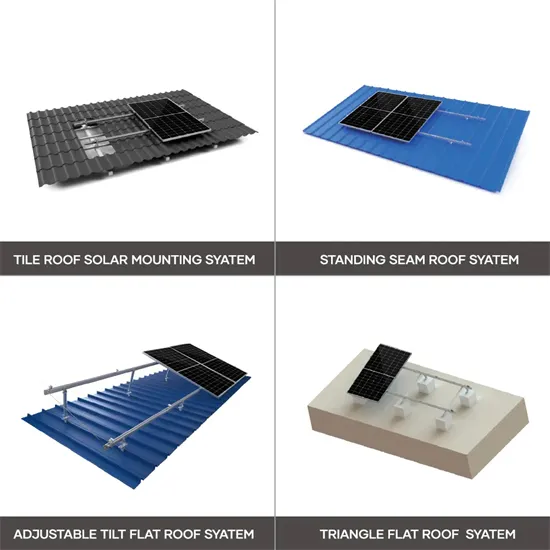

Wherever you are, we're here to provide you with reliable content and services related to BESS tax rate for energy storage power stations, including cutting-edge home solar systems, advanced photovoltaic panels, and tailored solar energy solutions for a variety of applications. Whether you're looking for residential rooftop installations, commercial solar projects, or off-grid power solutions, we have a solution for every need. Explore and discover what we have to offer!

What is the tax rate for energy storage power station income?

The tax rate applicable to income generated by energy storage power stations varies based on several factors including the jurisdiction, the nature of the business entity, and

WhatsApp Chat

Exploring Battery Energy Storage Systems (BESS)

Energy storage projects must adhere to labor standards in order to fully benefit from the tax incentives provided under the IRA. These criteria make sure that

WhatsApp Chat

Tax Opportunities for Battery Energy Storage Systems (BESS)

For projects that come online in 2023, 100% of those eligible costs are deductible for tax. For projects that come online in 2024 and 2025, 75% of those eligible costs are deductible for tax

WhatsApp Chat

Illinois Senator passes legislation to ramp up energy storage

Illinois State Senator Bill Cunningham. Image: Illinois Senate Democrats Illinois State Senator Bill Cunningham has passed legislation to accelerate energy storage in the

WhatsApp Chat

What the budget bill means for energy storage tax

Unlike solar and wind, which had their construction cutoff dates moved up, BESS projects will remain eligible for the investment tax credit

WhatsApp Chat

What the budget bill means for energy storage tax credit eligibility

Unlike solar and wind, which had their construction cutoff dates moved up, BESS projects will remain eligible for the investment tax credit (ITC) and production tax credit (PTC)

WhatsApp Chat

Battery energy storage systems: Benefits and tax incentives

Residential battery energy storage systems are eligible for the Residential Clean Energy Tax Credit under Section 25D of the Internal Revenue Code. The tax credit earned for

WhatsApp Chat

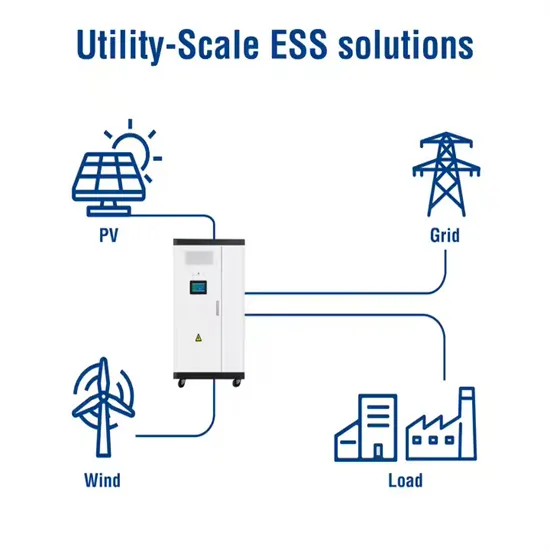

Utility-Scale Battery Storage in 2025: Navigating Tariffs, Tax

As of mid-2025, none of these rescinded orders have been replaced by equivalent initiatives. This rollback ends key interagency programs that supported clean energy and equity-focused

WhatsApp Chat

What is BESS? Battery Energy Storage Explained

Discover how Battery Energy Storage Systems (BESS) support renewable energy by balancing grids, storing solar and wind power, and

WhatsApp Chat

How a BESS System Works? -pknergypower

How Does a Battery Energy Storage System (BESS) Work? Introduction: Understanding the Power Behind Energy Storage As energy reliability

WhatsApp Chat

Battery Energy Storage Systems: A Game-Changer

As the energy landscape evolves, electric utilities are increasingly exploring innovative solutions to meet growing demands for reliability,

WhatsApp Chat

SALT and Battery: Taxes on Energy Storage | Tax Notes

With the evolution of battery storage to BESS, a combination of batteries delivering up to 300 megawatts, many jurisdictions are now treating BESS as producers of power and

WhatsApp Chat

Battery Storage Technology Tax Credit

The following Residential Clean Energy Tax Credit amounts apply for the prescribed periods: 30% for property placed in service after December 31, 2016, and before January 1, 2020

WhatsApp Chat

Investment Insights into Energy Storage Power Stations: Cost

2 days ago· Energy storage power stations have become vital pillars of the renewable energy transition. By storing excess electricity during low-demand periods and releasing it during peak

WhatsApp Chat

Battery energy storage in the NEM: Key trends in 2025

Energy Storage Summit Australia 2025 took place in March. This article summarises a presentation on key trends for battery energy storage in the NEM.

WhatsApp Chat

Tax rate for energy storage power stations

2021-0893591E5 EV Charging Stations and Power Storage Property a stand-alone energy storage property that is used for the purpose of storing electrical energy in a way

WhatsApp Chat

Battery Energy Storage Tax Credits in 2024 | Alsym Energy

Homeowners can take advantage of the Residential Clean Energy Credit, which provides a tax credit for battery storage systems with a capacity of at least 3 kilowatt-hours

WhatsApp Chat

BESS: Battery Energy Storage Systems

Battery energy storage systems (BESS) are a key element in the energy transition, with several fields of application and significant benefits for the

WhatsApp Chat

Battery Energy Storage Systems (BESS): How They

Battery Energy Storage Systems (BESS), also referred to in this article as "battery storage systems" or simply "batteries", have become

WhatsApp Chat

Exploring Battery Energy Storage Systems (BESS) under the

Energy storage projects must adhere to labor standards in order to fully benefit from the tax incentives provided under the IRA. These criteria make sure that registered apprenticeship

WhatsApp Chat

Battery Energy Storage Systems: A Comprehensive Guide for

Unlike C&I battery systems, utility-scale BESS farms operate at grid level, typically ranging from 1MWh to 100+ MWh in capacity. In fact, Malaysia''s National Energy Transition

WhatsApp Chat

Battery Energy Storage Tax Credits in 2024 | Alsym

Homeowners can take advantage of the Residential Clean Energy Credit, which provides a tax credit for battery storage systems with a capacity

WhatsApp ChatFAQs 6

What tax credits are available for energy storage projects?

Commercial/Grid-scale There is also a investment tax credit for larger energy storage projects. The Section 48 Investment Tax Credit offers businesses a similar 30% base tax credit for energy storage systems under 1 MW, or over 1 MW if certain apprenticeship and wage requirements are met.

Does Bess have a tax credit for solar?

Before the Inflation Reduction Act (IRA) was enacted in 2022, BESS could only access federal tax credit funding when powered by solar and required the business-owned storage to be charged with solar 75 percent of the time.

What are battery storage system tax credits?

Among the many provisions of the IRA, the introduction of battery storage system tax credits stands out as a major incentive for individuals and businesses looking to invest in energy storage solutions. These battery storage system tax credits aim to accelerate the adoption of energy storage technologies.

Are Bess projects eligible for ITC & PTC?

Unlike solar and wind, which had their construction cutoff dates moved up, BESS projects will remain eligible for the investment tax credit (ITC) and production tax credit (PTC) under sections 48E and 45Y respectively. Storage projects that start construction before 2033 will remain eligible for both the ITC and PTC.

Is a Bess a sales tax exclusion?

By contrast, a BESS co-located next to an active solar energy system is treated as part of that system and provided a 100 percent exclusion if the BESS is installed before the point of conveyance and the exclusion has not been taken. California law does not provide a sales tax exemption specifically for renewable energy storage systems.

How long does a Bess battery last?

With the evolution of battery storage to BESS, a combination of batteries delivering up to 300 megawatts, many jurisdictions are now treating BESS as producers of power and are applying the economic life equivalent of a conventional power generating facility to a BESS, which is up to 25 years.

Related reading topics

- Energy storage cabinet is industrial battery

- St Kitts and Nevis Flatbed Container Wholesale

- The UAE communication base station wind and solar complementary construction plan

- Somalia Energy Storage Charging Pile

- Yemen Monocrystalline Photovoltaic Panel Company

- 12v inverter size

- 10MW energy storage inverter

- Burundi Energy Storage Power

- Photovoltaic panel power generation characteristics

- Large-scale standalone energy storage cost model

- New container-type lithium battery

- Tanzania s new energy storage

- There are several specifications for medium voltage of photovoltaic panels

- Photovoltaic energy storage percentage

- Palau 45kw high quality inverter company

- Manufacture of portable AC and DC power supplies

- West Asia Power Storage